Guaranteed automobile protection (GAP) is an optional benefit offered to car buyers who finance their purchase. If the car is totaled in an accident, the consumer’s auto insurance typically pays only the fair market value of the car, which can be less than the amount the consumer owes on their loan. GAP applies in that situation to cancel, or pay off, the remaining balance owed on the loan. Consumers typically pay for GAP through a lump sum payment at the time they purchase a vehicle and often that payment is rolled into the principal loan balance. The coverage lasts the entire term of the loan, but if the loan is paid off early such as through the sale or repossession of the vehicle then the consumer is entitled to a refund of the unused or unamortized portion of the GAP fee.

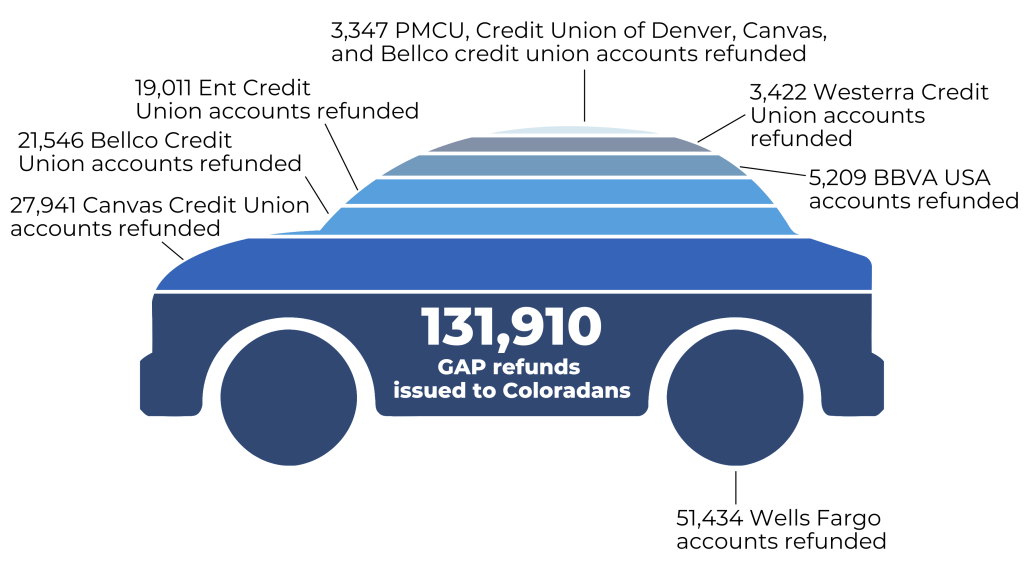

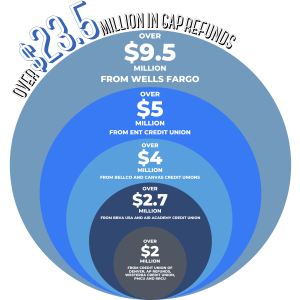

Attorney General Phil Weiser is committed to defending Colorado GAP consumers and holding GAP providers and financial institutions accountable for deceiving or withholding funds rightfully owed to consumers. Since 2019, Attorney General Weiser’s office has secured over $23.5 million in GAP refunds to nearly 132,000 Coloradans.

How did the Attorney General’s Office secure the GAP refunds?

Wells Fargo

In March 2021, the Attorney General’s Office secured over $9.5 million in refunds for over 50,000 Coloradan Wells Fargo accounts after the company charged its consumers unnecessary GAP fees and failed to refund unearned GAP fees owed to Colorado consumers. As part of a multi-state investigation, Wells Fargo made refunds totaling $82.4 million to U.S. consumers, including over $9.5 million to Coloradans. For more on this settlement, click here.

BBVA USA & Air Academy Federal Credit Union

In September 2021, the Attorney General’s Office found that BBVA USA (formerly Compass Bank) and Air Academy Federal Credit Union did not refund the unearned GAP fees for many consumers as required by Colorado law. In the settlements, the lenders agreed to comply with their legal obligations and to pay consumers what they are owed. In total, BBVA USA refunded over $1.5 million to 5,209 Coloradan consumers while Air Academy Federal Credit Union refunded over $1 million to Coloradans. For more on our work for BBVA USA and Air Academy Federal Credit Union borrowers, click here.

Westerra Credit Union

In October 2021, Attorney General Weiser announced that Westerra Credit Union refunded Colorado borrowers after failing to return GAP fees to consumers. Westerra provided nearly $850,000 in refunds to 3,422 Colorado consumers and paid the Attorney General for the costs of its investigation. For more on this settlement, click here.

Ent Credit Union, Premier Members Credit Union (PMCU), & Credit Union of Denver

In March 2022, the Attorney General’s Office led investigations into Ent, PMCU, and Credit Union of Denver which revealed that they neglected to refund unearned gap fees for many Colorado consumers. The settlements announced that the lenders refunded over $6.5 million in refunds for 22,318 Coloradan borrowers. Individually, the three lenders made the following refunds:

- Ent made 19,011 refunds totaling over $5.16 million;

- PMCU refunded $792,873 to 2,563 consumers and;

- Credit Union of Denver refunded $122,022 to 744 consumers.

For further details on these settlements, click here.

Red Rocks Credit Union

In June 2022, the Attorney General’s Office assisted in securing refunds for more Coloradan borrowers. Red Rocks Credit Union failed to return money to consumers for unearned GAP fees. Following an investigation spearheaded by a private class action council, the Attorney General’s Office announced that Red Rocks refunded over $300,000 in GAP refunds to 1,328 Coloradans and paid these Coloradans interest resulting from the delayed payment. For more on our work for RRCU borrowers, click here.

Bellco and Canvas Credit Unions

In January 2023, the Attorney General’s Office led an investigation into Bellco and Canvas credit unions which revealed that Bellco and Canvas historically were not refunding unearned GAP fees owed to consumers. The settlements announced that the lenders refunded over $4 million in refunds to 49,487 Coloradans. Individually, the two lenders made the following refunds:

- Bellco refunded $1.4 million to 21,546;

- Canvas refunded $2.6 million to 27,941.

For more on these settlements, click here.

Borrowers who believe they are owed a GAP fee refund because they paid off a car loan early or did not receive a full benefit for GAP coverage can file a complaint here.